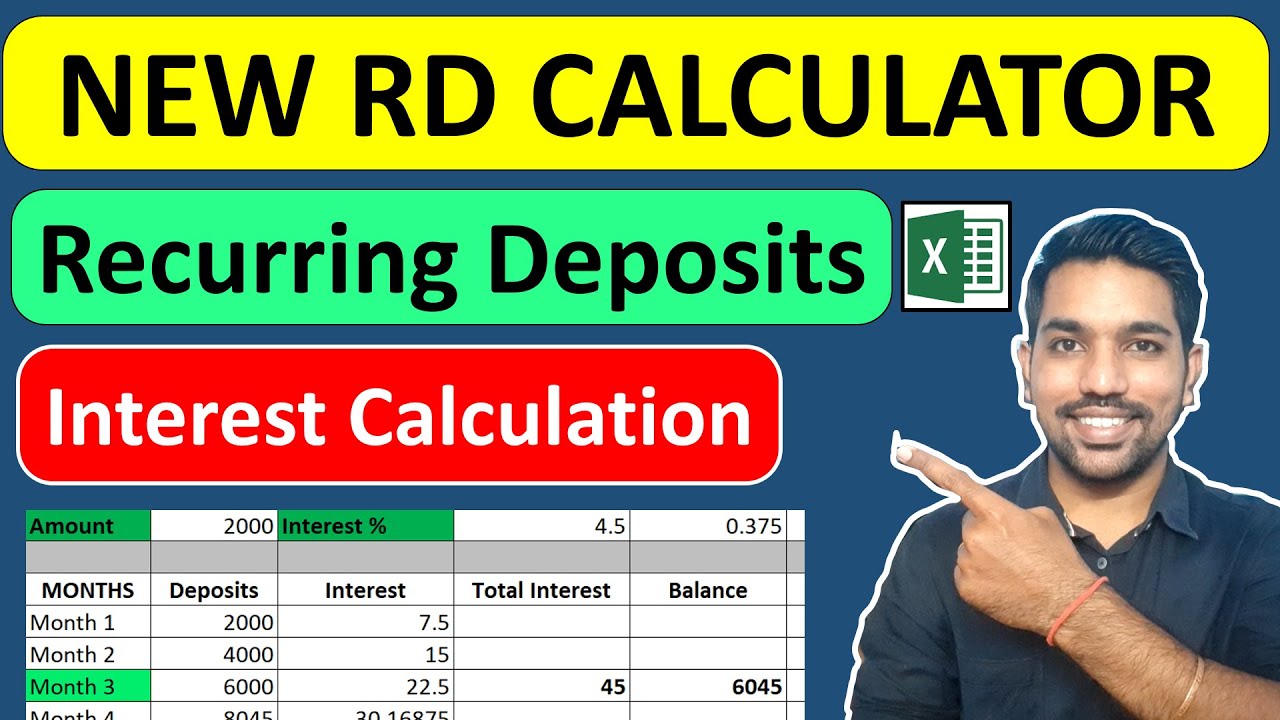

RD Calculator | Recurring Deposit Interest Calculation with Excel Examples [Hindi]

In this video by FinCalC TV we will see New RD Calculator on fincalc blog with examples of recurring deposit interest calculations. RD full form is Recurring Deposits. You can open RD in any bank or post office to achieve your short term goals like buying a smartphone or paying life insurance premiums. RD compounding is done quarterly so the monthly interest amount is added to your balance every quarter when minimum tenure is 6 months.

RD Calculator Link:

[ Ссылка ]

All Excel calculators videos:

[ Ссылка ]

DOWNLOAD ANDROID APP "FinCalC":

[ Ссылка ]

SIP Calculator Video:

[ Ссылка ]

CHAPTERS:

00:00 RD Calculator Intro

00:21 What is RD and why to open RD?

02:12 Features of Recurring Deposits

02:45 RD Calculator Demo examples

07:45 RD Calculator using excel

09:01 Compounding Example in RD

09:51 RD Monthly Interest Calculation formula

13:21 More excel videos

14:46 RD Calculator Conclusion

WHAT IS RD?

RD or Recurring Deposit is one the popular saving options in India that will help you to accumulate some predefined amount with the help of regular savings in Recurring Deposit. You can easily open RD in your bank using Internet banking or in post office. RD is usually done to achieve short term goals with no risk involved. The maturity amount in RD is guaranteed hence there is no risk. Recurring Deposit Interest Calculator will help you to know the interest you’ll get in Recurring Deposit.

GOALS WHILE OPENING RD ACCOUNT

It is important to have goals in mind before opening a RD or Recurring Deposit. You can have below short term goals while booking an RD:

- To buy a new smartphone with budget around Rs. 10,000, you can open a RD of Rs. 2,000 for 6 months

- To pay your Life insurance premium of Rs. 35,000 next year, you can open RD of Rs. 3,000 for 12 months

Similarly, you can open RD for goals you feel are important for next 6 months of 1 year. This helps you accumulate funds gradually without any pressure of spending the current funds in one go instantly!

FEATURES OF RD

RD - also called as Recurring Deposit is the type of account you open considering a goal in mind which are usually short term – 6 months to 2 years

You regularly deposit in your recurring deposit account for a predefined period and accumulate sufficient amount to reach your goal

While you deposit your money in recurring deposit, you get interest amounts based on the interest rate that is set during recurring deposit account opening

The goals for opening an RD can be to pay for the next insurance premium, buying a new phone, etc.

So instead of paying EMIs on such goals, you open recurring deposit account as a part of planning for your goal

Another advantage of opening recurring deposit is that you earn additional interest instead of paying this additional interest which happens in paying the EMIs (in case your convert the buying amount to EMIs)

The calculation of recurring deposit interest is similar to that of Fixed Deposit Interest Calculation. Compounding is done on quarterly basis in most of the banks

HOW RD CALCULATOR WORKS

As mentioned above, you deposit pre defined amount every month and accumulate the required amount to be achieved as your maturity amount in recurring deposit

The interest is calculated on monthly basis based on the monthly interest rate derived from the annual interest rate, and this interest is than added to your balance every quarter. This is how compounding works in recurring deposit

RECURRING DEPOSIT INTEREST RATES

Recurring Deposit interest rates ranges between 3.5% to 6% annually from bank to bank

HOW TO OPEN RECURRING DEPOSIT ACCOUNT

Popular banks such as SBI, HDFC, ICICI, Axis, etc. provide you this facility to open recurring deposit online via internet banking

#RDCalculator #RecurringDeposit #interestcalculation #FinCalC

============================

LIKE | SHARE | COMMENT | SUBSCRIBE

Mujhe Social Media par FOLLOW kare:

Facebook : [ Ссылка ]

Twitter : [ Ссылка ]

BLOG: [ Ссылка ]

Telegram: [ Ссылка ]

Instagram: [ Ссылка ]

====

MORE VIDEOS:

SIP Excel Calculator: [ Ссылка ]

Loan EMI Calculator: [ Ссылка ]

20 Years SIP Calculator: [ Ссылка ]

Loan EMI Prepayment Calculator: [ Ссылка ]

====

DISCLAIMER:

Examples and demo used are for Illustration purpose only and might not cover every detail of examples shown. It is advised to seek professional help before taking any financial decisions. The owner of this channel shall not be liable in any way.