Married Filing Taxes Jointly vs Separately - Which Is Better? (What Are The Differences?). In this comparison video I will talk about Married Filing Taxes Jointly vs Separately.

So, the main difference between them is the benefits offered.

Couples that file their taxes jointly stand to benefit from more tax credits offered by the IRS. The benefits include 'Earned tax credits' and 'Child and independent care credits.' To discourage separate tax filings, the 'Internal Revenue Service' does not offer benefits to couples filing the returns separately. In individual filings, the couples are automatically disqualified from the benefits.

Filing jointly, therefore, gives the couple a chance to enjoy more benefits such as ‘Earned tax credit.’

Liabilities and penalties

When you file taxes jointly with your partner, just as you benefit together, you'll be liable for any liabilities or penalties issued to you by the IRS. For example, if one partner happens to have taxes that they owe to the government or have defaulted on federal student loans, they'll be taxed together with the person they're married to. Filing taxes separately, on the other hand, exempts individuals from their partner's liabilities; for example, if an individual happens to have defaulted on a federal student loan in the past, they'll pay alone.

Therefore, in joint filings, couples are tied to their partner's liabilities and penalties if they happen to come by.

Tax bracket

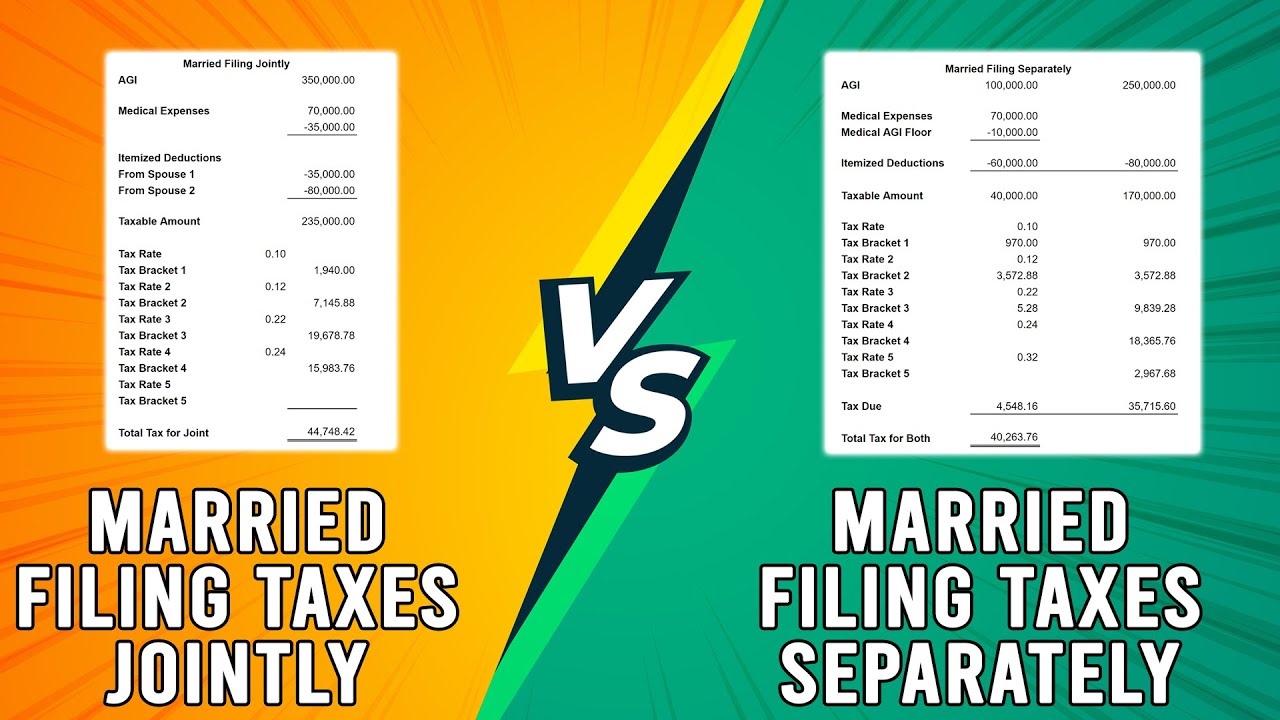

Tax brackets are wider for joint fillings. Partners jointly filing their taxes will, therefore, pay reduced taxes, especially if one partner earns a significantly low income. Separate filing, on the other hand, has a reduced tax bracket. The partners will pay more taxes, especially if one partner earns significantly less.

Couples in a joint filing, therefore, benefit from lower tax amounts paid if one of the partner earners has a lower income in relation to the other.

But do they have any similarities?

Yes. Both methods can give couples a lower tax rate if they choose appropriately, depending on their income. If one partner earns a lower income than the other, joint filing enables them to pay lower taxes. On the other hand, if both partners earn almost equal incomes, they'll also pay a lower tax if they pick separate filing.

So, to sum up, how do they compare- Joint or Separate filing?

Separate filing has the benefit of holding each individual liable for their liabilities, a significant advantage if you choose the method. However, I consider the joint method more appealing due to the IRS benefits that accompany it and the lower tax limit when one partner earns a little income.

If you found this video helpful, kindly show your support by giving it a thumbs up and sharing your thoughts in the comments below. Your feedback is greatly appreciated. Thank you!

►Disclaimer◄

This channel DOES NOT promote or encourages any illegal or unethical activities and all content provided by this channel is meant for EDUCATIONAL PURPOSES only.

This video is solely intended for educational purposes only. The information presented has been thoroughly researched and sourced from reputable outlets, including, but not limited to, Google, social media platforms, and online forums. Our team has meticulously crafted original content centered around this topic, utilizing a comprehensive approach to ensure accuracy and reliability.

The Savvy Professor is a YouTube channel that provides up-to-date information on various topics, ranging from finance ,technology ,gaming, how-to tutorials, product reviews, and roundups. Our channel is dedicated to delivering informative, original, and unbiased content that viewers can appreciate.

I believe all content used falls under the remits of Fair Use, but if any content owners would like to dispute this I will not hesitate to immediately remove said content. It is not my intention to in any way infringe on their content ownership. If you happen to find your art or images in the video please let me know and I will be glad to credit you / Take down the content. Business e-mail: juicewave23 { @ } gmail.com

.................................

Content Credit :

The visual content featured in this video has been obtained from reputable sources, including Google Images, official websites, and stock footage clips.

Furthermore, the information presented in this video has been derived from various reliable data sources, such as Wikipedia, Google search, Forums and other social media platforms.

The video has been professionally edited using a combination of Adobe Premiere and Adobe After Effects, to create original content thats is engaging for our viewers.

.....................................

FTC Disclosure: The Savvy Professor is a participant of Amazon Affiliate Program. Provided Amazon product links are linked to my Amazon Affiliate account & I receive small commissions from every successful purchase made using these links.