SIP Returns Calculation Examples with ₹1000 for 1-15 Years| Calculate SIP Returns (Hindi)

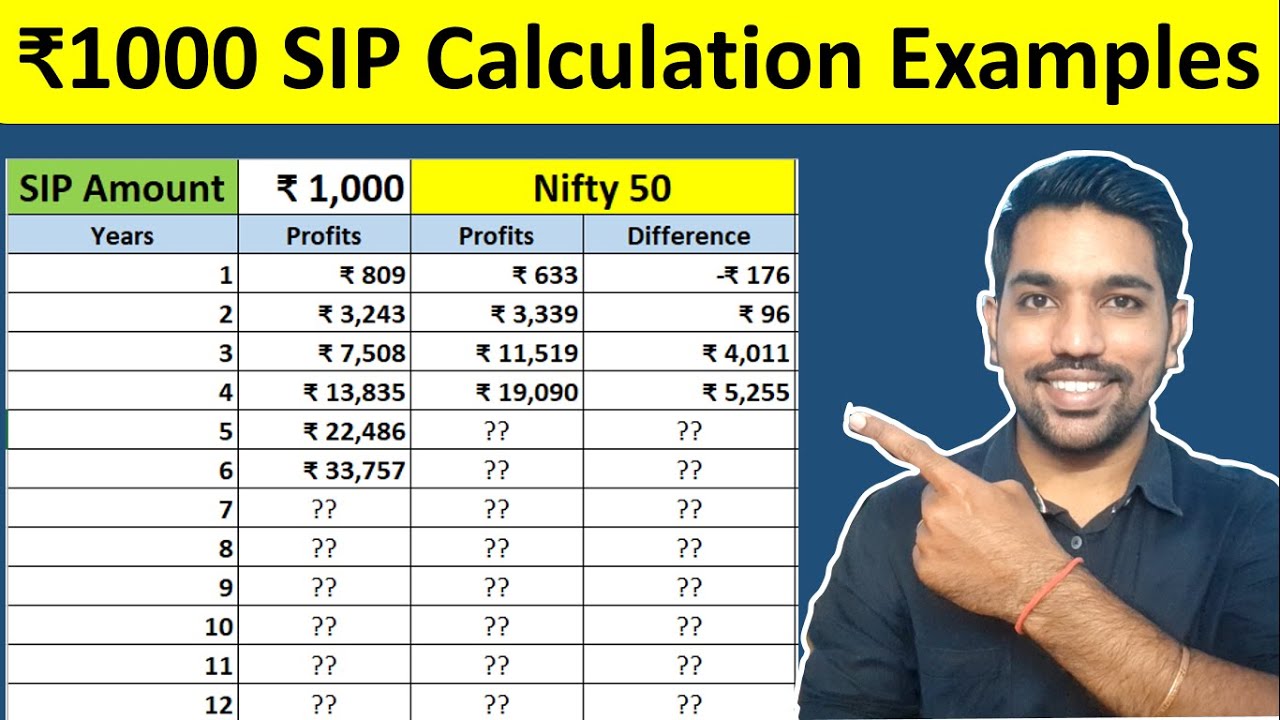

In this video by FinCalC TV we will see how to calculate SIP (Systematic Investment Plan) returns easily with the help of the calculator I have made for you on my website fincalc blog. We will take example of Rs. 1000 monthly SIP and calculate returns from 1 year to 15 years, so you will get the idea of your SIP returns for 5 years, 10 years or 15 years SIP investment.

We will also compare returns with actual returns of HDFC Nifty 50 Mutual Fund.

Note that the income tax on SIP returns is not included in examples so SIP returns should be adjusted accordingly.

SIP Calculator Online:

[ Ссылка ]

FinCalC Blog:

sip returns calculation examples Rs. 1000 SIP investment in hindi video

Mutual Funds for Beginners:

[ Ссылка ]

Best Mutual Funds for 2023:

[ Ссылка ]

JOIN Telegram Group:

[ Ссылка ]

CHAPTERS:

00:14 SIP Calculation Examples Intro

01:10 SIP Returns Tracking Excel

02:09 SIP Returns Calculator Online

03:05 Rs.1000 SIP Returns Calculation

07:31 Comparison with Nifty 50 Mutual Fund

12:28 More Excel Calculator Videos

12:49 SIP Calculation Examples Conclusion

13:14 JOIN my Telegram Group

Rs. 2000 SIP Returns Calculation

[ Ссылка ]

All Excel calculators videos:

[ Ссылка ]

WHAT IS MUTUAL FUNDS SIP?

SIP full form is Systematic Investment Plan. SIP is a way to invest in mutual funds or any investment option every month regularly. In this article we will consider SIP as investments in mutual funds for simplicity. You can also do SIP in Stocks or Shares of companies.

Below are some benefits of SIP:

Rupee Cost Averaging: This is the term derived from dollar cost averaging but let’s understand this in terms of rupee! The fact that SIP invests in mutual funds regularly, helps you to buy less mutual funds units when market goes up (price goes up) and more mutual funds units when market goes down (price goes down). We will see this in examples below.

Lowering risk: As compared to lump sum investing where you invest entire amount in one go after seeing a small drop in market, your SIPs help you to balance your investment value by seeing the ups and downs of market while helping you invest regularly. This lowers the risk in SIP.

Mental Strength: In SIP you do not pay huge amount up front like lump sum investing. You always pay a fraction of amount which you can afford to invest and reap benefits over long term.

Achieving goals: You must have heard about – “Slow and steady wins the race“. It’s not about the sprints that you take but it’s about the marathon that you win slowly and with patience. SIP helps in achieving your long term goals by keeping aside some amount of money every month.

HOW DO YOU CALCULATE SIP IN EXCEL?

Watch full video to calculate SIP returns in Excel

============================

LIKE | SHARE | COMMENT | SUBSCRIBE

Mujhe Social Media par FOLLOW kare:

Facebook : [ Ссылка ]

Twitter : [ Ссылка ]

BLOG: [ Ссылка ]

Telegram: [ Ссылка ]

Instagram: [ Ссылка ]

============================

MORE VIDEOS:

SIP Excel Calculator: [ Ссылка ]

Income Tax Calculator: [ Ссылка ]

Loan EMI Calculator: [ Ссылка ]

Loan EMI Prepayment Calculator: [ Ссылка ]

============================

DISCLAIMER:

Examples and demo used are for Illustration purpose only and might not cover every detail of examples shown. It is advised to seek professional help before taking any financial decisions. The owner of this channel shall not be liable in any way.

Credits:

[ Ссылка ]

![ТРЕЙДИНГ КРИПТОВАЛЮТ С НУЛЯ [полный гайд в одном видео]](https://i.ytimg.com/vi/rFGeW_aalQc/mqdefault.jpg)

![Дубайская Авантюра 16 - Папич и Понасенков [Перезалив]](https://i.ytimg.com/vi/DzFRbN_ZHR8/mqdefault.jpg)