Approximately 153 million people across West Africa have no access to electricity, according to the International Renewable Energy Agency, IRENA, yet the region has abundant wind and solar energy investment opportunities and additional hydropower potential. The high costs of maintaining and expanding national grids open up market opportunities for renewable mini-grids. The Economic Community of West African States, ECOWAS, has set a target of an additional 60,000 mini-grids and 2.6 million stand-alone systems in the region serving 71.4 million people by 2020. ECOWAS has also set a target of developing 128,000 clean energy-powered mini-grids by 2030.

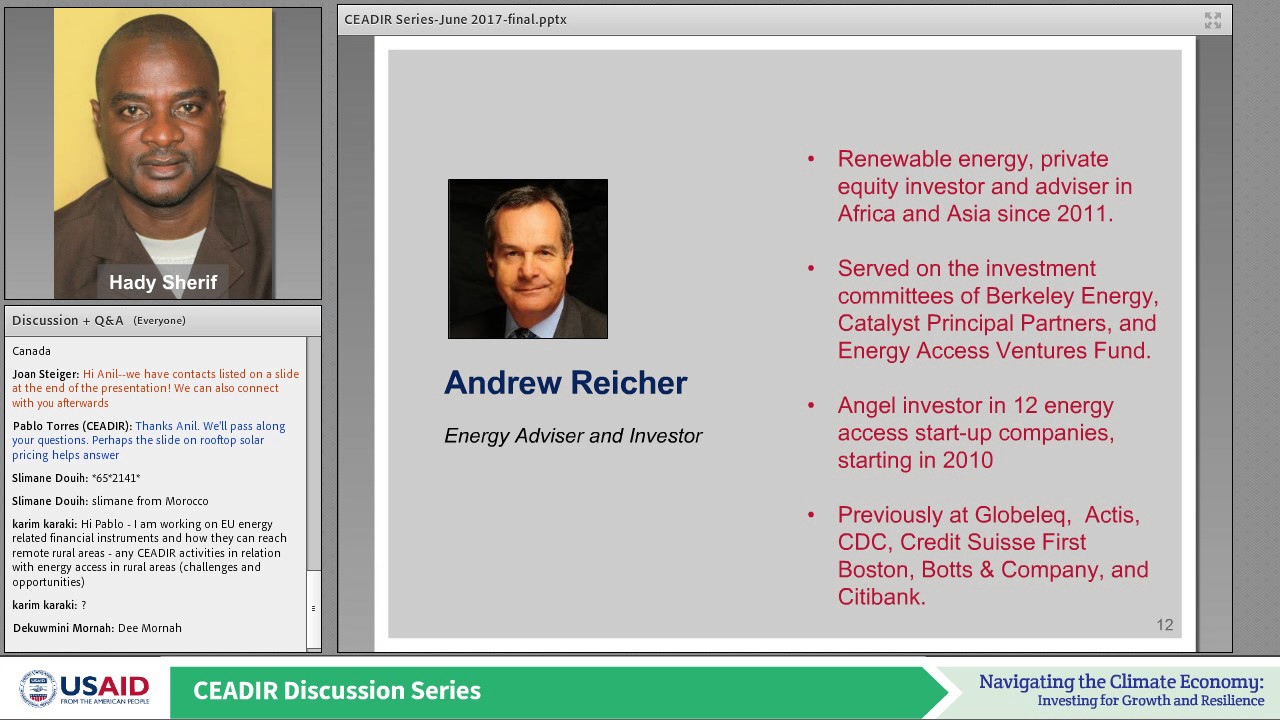

On June 29, 2017, the CEADIR Series hosted “Investment Opportunities in Renewable Energy and Electric Grids in West Africa.” The webinar featured:

• Charles Ayenu, CEADIR’s West Africa Regional Coordinator, who provided an overview of CEADIR’s activities in West Africa, including the results of clean energy market assessments in seven countries: Côte d’Ivoire, Ghana, Guinea, Liberia, Niger, Nigeria, and Senegal.

• Andrew Reicher who presented his perspective as a renewable energy investor in Africa on the challenges, opportunities, and actions to increase clean energy adoption.

• Hady Sherif, Director of Energy for the Millennium Challenge Account in Liberia, who discussed the Account’s energy market development activities, including energy sector reforms, the rehabilitation of the Mt. Coffee hydropower project, and training to rebuild the country’s power sector.

• Chris Camponovo, Head of Business Development for Sparkmeter, who described the company’s work with electricity distribution companies and mini-grids in Nigeria using low-cost, pre-pay enabled, smart metering systems.

*Note: Technical difficulties caused audio drop-off between 20:21-24:25.

Key takeaways from the event:

• CEADIR is assessing the clean energy lending market in seven West African countries: Côte d’Ivoire, Ghana, Guinea, Liberia, Niger, Nigeria, and Senegal. Most countries have the necessary elements to create an enabling environment for clean energy investors—including renewable energy laws and mini-grid policy. There are also significant opportunities for investors and commercial banks to fund off-grid and beyond-the-grid projects (4:00-8:45).

• In West Africa, grid-scale renewable power generation is working—large amounts of capital are going into solar, hydro and wind plants that are connected to the grid, as well as large-scale distribution grids. Large-scale renewables are the cheapest generation option to generate power (11:15-12:00).

• In Liberia, inadequate infrastructure, weak regulatory environment, and small market size continues to be significant challenges. To tackle this, the Millennium Challenge Account-Liberia is taking on three key activities: rehabilitate the Mt. Coffee Hydropower Plant to increase generation, develop the capacity of the Liberia Electricity Corporation to better its operational abilities, and lead a sector reform program to attract funding to the power sector and strengthen the regulatory environment (20:20-23:00).

• Smart metering solutions offer central grid utilities and micro-grid utilities the ability to scale, through more reliable load management, automatic payment collection to reduce costs, and greater accessibility to verify consumption, reliability, and payment (27:00-30:00).

Download the presentation: [ Ссылка ]