[ Ссылка ]

How to Generate IFTA Report using ExpressIFTA

You have to turn in your IFTA report 4 times a year, what a hassle. That means that every quarter you have to sit down and spend hours dealing with math and trip sheets to figure out your IFTA totals.

But there's a better way! You can use ExpressIFTA to save tons of time on your IFTA fuel tax reports! Our innovative features streamline the reporting process so you can effortlessly track your mileage and fuel records to instantly complete your IFTA return each quarter.

If you’re looking for the easiest way to prepare your IFTA fuel tax return, then start by creating a free account. Click "New User" and enter your business information to register your account. If you are a tax preparer then check the "tax professional box." If not, proceed to create an account.

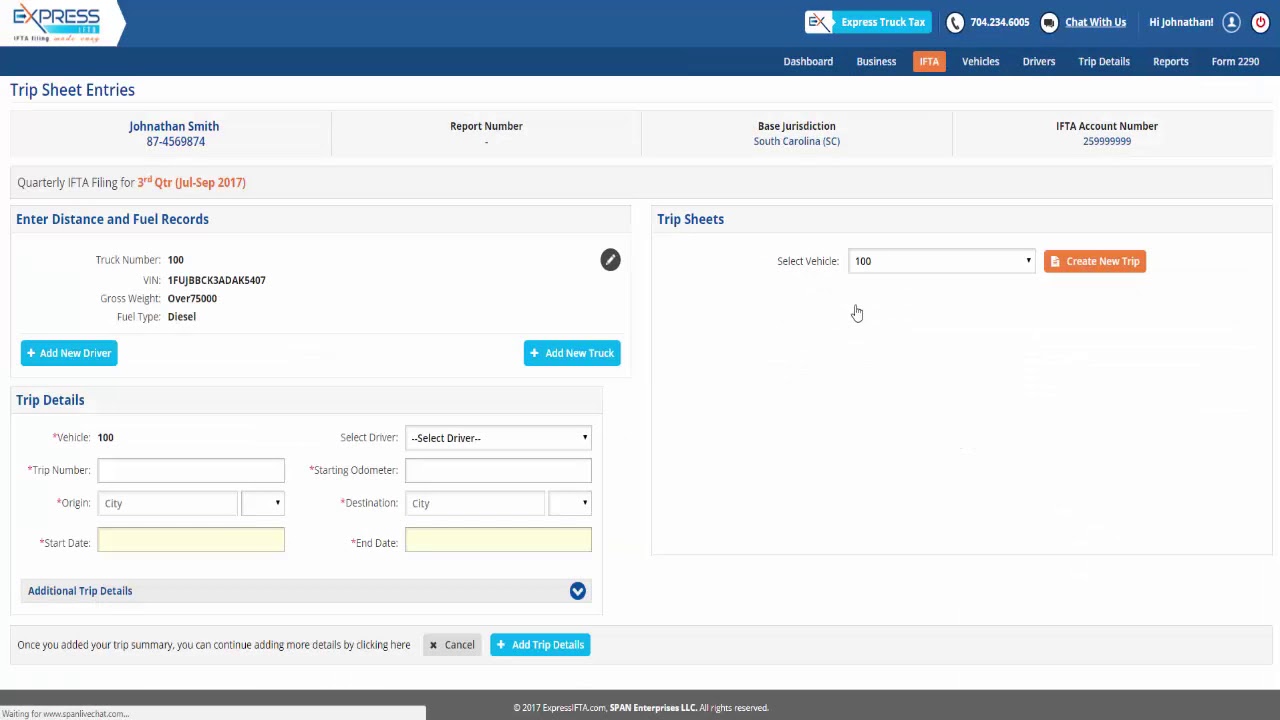

ExpressIFTA will allow you to keep detailed records for each trip you travel during the quarter with our detailed trip sheets. Simply select the vehicle you would like to enter a trip for to get started.

Then you will enter your odometer reading from the beginning and end of your trip, the starting and end location, as well as the start and end date.

Once your trip summary is complete you can add your mileage and fuel records. Enter your miles traveled per jurisdiction by odometer readings or distance and then break them down by taxable or nontaxable. Then enter the fuel purchased per jurisdiction and the totals will automatically be calculated for your IFTA return.

Or use the quick entries screen to enter all of your miles traveled and fuel records for a month at a time. You can enter your information by date and include trip numbers. Simply enter the miles traveled and fuel purchased per jurisdiction by day.

Your mileage can be recorded by distance or odometer readings can include information about your trip such as if your trailer was loaded, empty, bobtail, deadhead, etc, if you would like.

But why enter in your information manually when it can be bulk uploaded with ExpressIFTA? Simply upload all of your odometer or distance records at once with our excel template or by using your own excel or .CSV file. Our system provides step-by-step instructions to make the process quick and easy.

You can also quickly upload all of your distance information by uploading it to your ExpressIFTA account from your GPS. If ExpressIFTA doesn’t support the type of GPS you have, simply email your GPS report to support@ExpressIFTA.com

Based off of the information you enter, ExpressIFTA will automatically calculate your IFTA totals in an easy to read IFTA report that can be printed and emailed.

We will also automatically calculate the amount of IFTA tax you owe, so you don’t have to worry about doing any complicated calculations yourself. Best of all, the report can be used to complete your quarterly IFTA return in a matter of minutes.

How to Generate IFTA Report using ExpressIFTA

Теги

ExpressIFTAExpress IFTAIFTAHow to Generate IFTA Report using ExpressIFTAOnline IFTA Reporting SoftwareHow to generate your IFTA quarterly report with ExpressIFTAWhat is Quarterly Fuel Tax ReportingIFTA Reporting SoftwareFuel Tax Reporting SoftwareWhat are IFTA ReportsWhat are IRP Reportsiftafuel taxfuelEasily generate your IFTA quarterly fuel tax report with accurate fuel tax calculations