Welcome to the Investors Trading Academy talking glossary of financial terms and events.

Our word of the day is “Big Mac index”

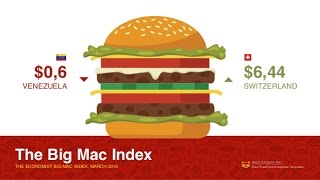

The Big Mac index was devised by Pam Woodall of the Economist in 1986, as a light-hearted guide to whether currencies are at their "correct" level. It is based on one of the oldest concepts in international economics, purchasing power parity (PPP), the notion that a dollar, say, should buy the same amount in all countries. In the long run, argue pop fans, currencies should move towards the exchange rate, which equalizes the prices of an identical basket of goods and services in each country. In this case, the basket is a McDonalds' Big Mac, which is produced in more than 100 countries. The Big Mac PPP is the exchange rate that would leave hamburgers costing the same in the United States as elsewhere. Comparing actual exchange rates with PPP signals whether a currency is undervalued or overvalued. Some studies have found that the Big Mac index is often a better predictor of currency movements than more theoretically rigorous models.

By Barry Norman, Investors Trading Academy - ITA

What is The Big Mac index?

Теги

Barry NormanITAInvestors Trading AcademyFinance EducationAnalysisHow to TradeMake MoneyFinance WordsFinance VocabularyUnderstanding FinanceITA Finance EducationStock MarketFuturesInvestmentEconomyTradingNewsTechnicalOptionsAcademyTalking Financial GlossaryEconomic ChannelEducational ClassesITA.academyForexStocksBig Mac index

![অধ্যায় ১ : জীবন পাঠ - জীববিজ্ঞানের ধারণা ও জীববিজ্ঞানের শাখাসমূহ [SSC]](https://i.ytimg.com/vi/AOT_qqpE0FI/mqdefault.jpg)

![অধ্যায় ১২: মহাকাশ ও উপগ্রহ [Class 8]](https://i.ytimg.com/vi/LV4qP_FuTRI/mqdefault.jpg)

![অধ্যায় ৭: পৃথিবী ও মহাকর্ষ [Class 8]](https://i.ytimg.com/vi/EkQsZVJnqCc/mqdefault.jpg)

![অধ্যায় ০১ - রসায়নের সাথে বিজ্ঞানের অন্যান্য শাখার সম্পর্ক, রসায়ন পাঠের গুরুত্ব [SSC]](https://i.ytimg.com/vi/1NDKuhy3WBc/mqdefault.jpg)

![অধ্যায় ২: জীবের বৃদ্ধি ও বংশগতি [Class 8]](https://i.ytimg.com/vi/pS4ZxQk7fLQ/mqdefault.jpg)

![অধ্যায় ১: জীবন পাঠ - জীবজগৎ এর রাজ্যসমূহ [SSC]](https://i.ytimg.com/vi/LsegXsn40rs/mqdefault.jpg)