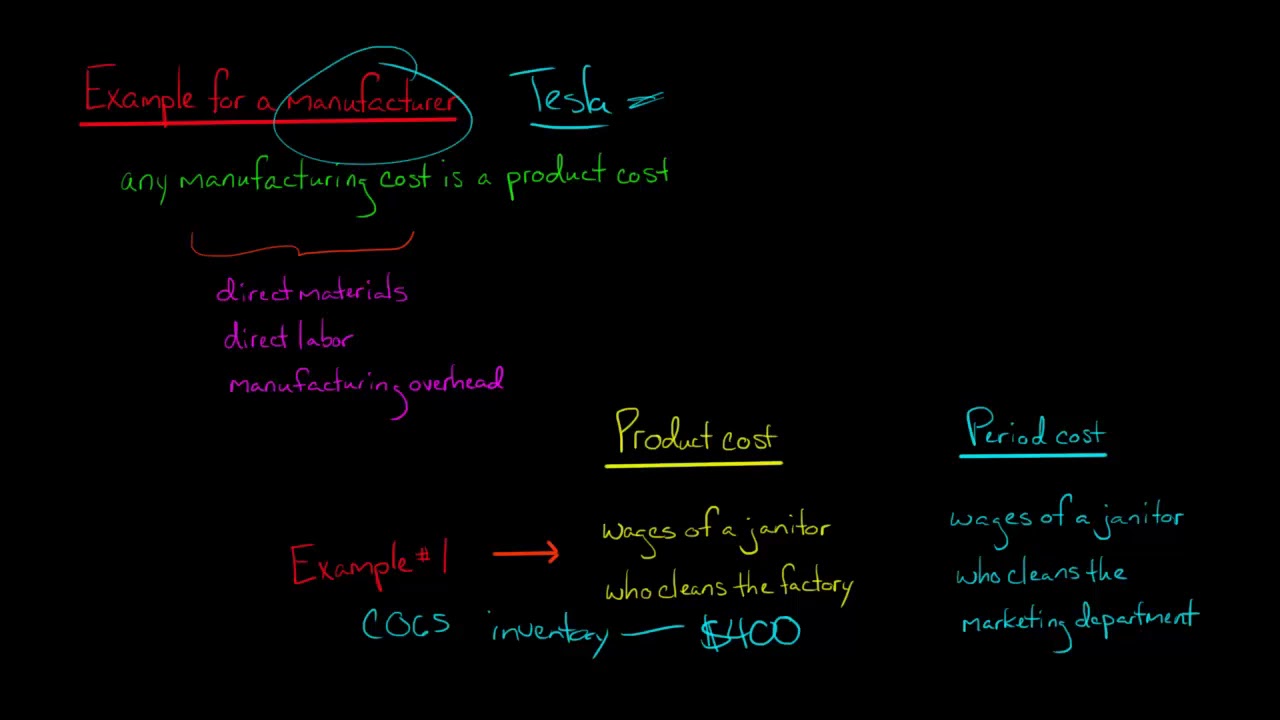

Manufacturers, retailers, and any company with inventory must distinguish between product costs and period costs. The difference between product costs and period costs has to do with the timing (when the cost is expensed).

A product cost is assigned to inventory, and is expensed when the product is sold through Cost of Goods Sold. For a manufacturer, product costs include all manufacturing costs: direct materials, direct labor, and manufacturing overhead. These costs first become an asset (inventory) and are expensed when the asset is sold.

A period cost is any cost that is not a product cost. Period costs are expensed when they are incurred. Selling, general, and administrative expenses are an example of a period cost. If a manufacturer pays a sales commission to one of its sales staff, this cost is expensed and does not attach to inventory.—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

* [ Ссылка ]

—

SUPPORT EDSPIRA ON PATREON

*[ Ссылка ]

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

* [ Ссылка ]

—

LISTEN TO THE SCHEME PODCAST

* Apple Podcasts: [ Ссылка ]

* Spotify: [ Ссылка ]

* Website: [ Ссылка ]

—

GET TAX TIPS ON TIKTOK

* [ Ссылка ]

—

ACCESS INDEX OF VIDEOS

* [ Ссылка ]

—

CONNECT WITH EDSPIRA

* Facebook: [ Ссылка ]

* Instagram: [ Ссылка ]

* LinkedIn: [ Ссылка ]

—

CONNECT WITH MICHAEL

* Twitter: [ Ссылка ]

* LinkedIn: [ Ссылка ]

—

ABOUT EDSPIRA AND ITS CREATOR

* [ Ссылка ]

* [ Ссылка ]