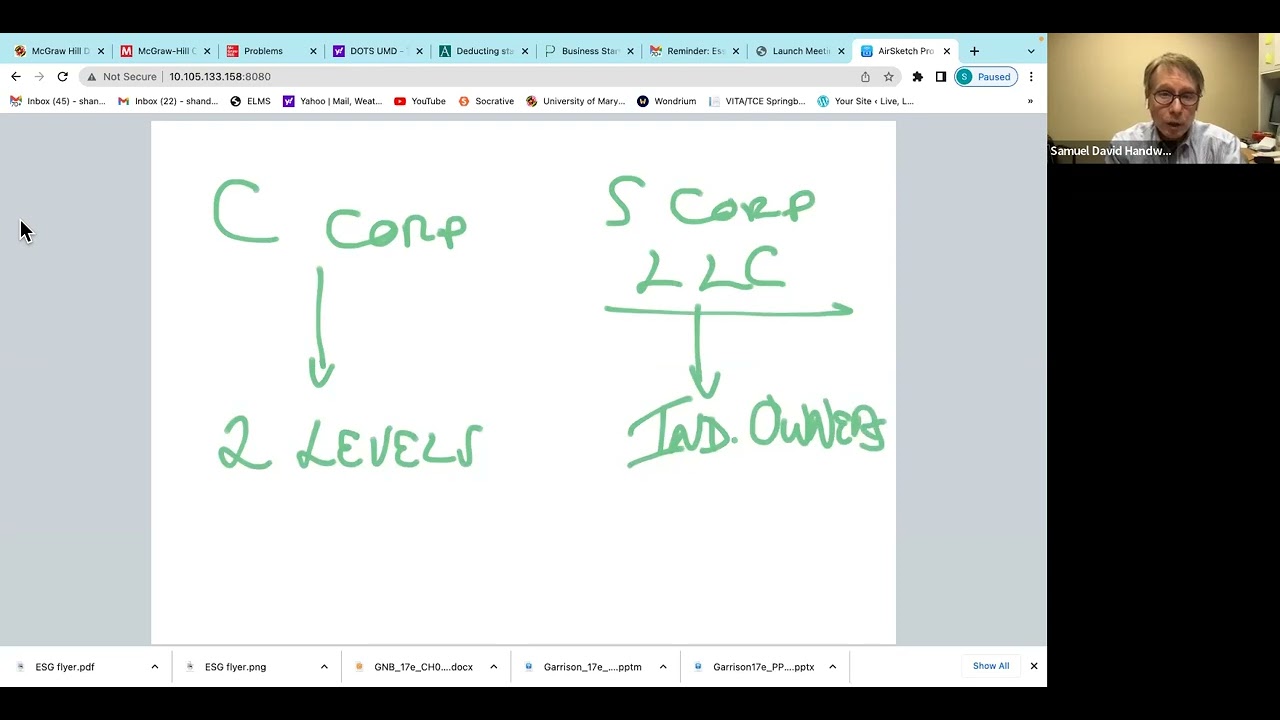

Taxes are probably the last thing on a mind of an entrepreneur when forming a startup. However, there are very important issues to consider when forming and operating a company, including choice of entity (LLC? C Corp? etc.), reporting requirements, sales tax compliance, multi-state tax issues, and, of course, not missing any available deductions to lower tax. Please join Samuel Handwerger, CPA & MS in Taxation, Lecturer at the R.H. Smith School of Business at the University of Maryland to learn about essential tax issues all startup founders should be aware of.

Presenter: Samuel Handwerger, CPA, MS in Taxation, Lecturer at the Robert H. Smith School of Business, University of Maryland