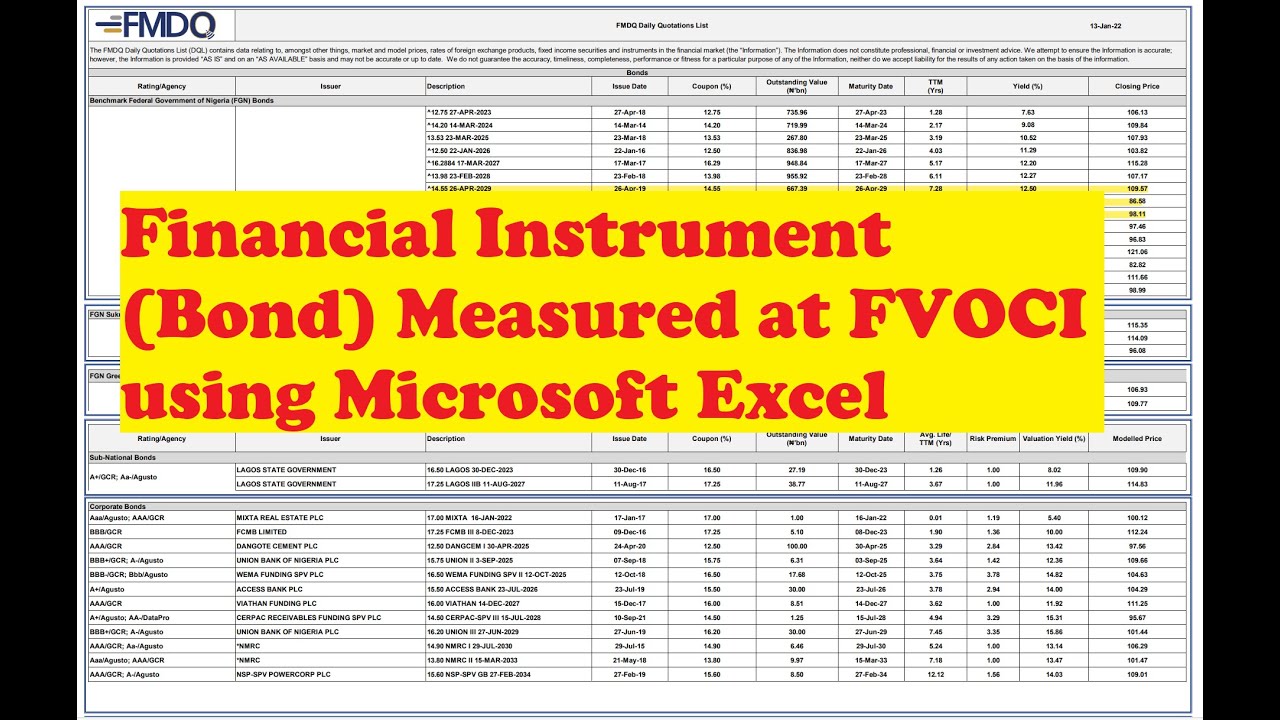

Financial Instrument Measured at FVOCI!!!

I have put together a new video to help accountants and financial analysts calculate value of a bond measured at FVOCI using Microsoft Excel.

According to IFRS 9, Financial instruments are measured at:

(a) Amortised cost

(b) Fair value through P&L (FVTPL)

(c) Fair value through OCI (FVOCI)

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

For fair value OCI financial instrument,

A debt instrument is measured at FVOCI only if it meets both of the following conditions:

(i) the asset is held within a business model whose objective is achieved by both collecting contractual cash flows and selling financial assets; and

(ii) the contractual terms of the financial asset meet the SPPI criterion.

Interest income is calculated using the effective interest method and recognised in profit or loss why any gain or loss on a financial asset measured at FVOCI is recognised in other comprehensive income, except for impairment gains or losses.

Note that just like Amortised cost instruments, FVOCI instrument is assessed for ECL impairment.

If you have not yet subscribed to my YouTube channel, please do to click on the subscribe button and turn on notifications.

To support my channel and content. Here is my PayPal account -

[ Ссылка ]

Happy viewing and see you in next video.

#financialmodeling #financialinstruments #financialassets #ifrs9 #fairvalue #oci #bondmarket #accountants #auditors #financialstatements #exceltutorial #financialanalyst

![JavaScript - Полный Курс JavaScript Для Начинающих [11 ЧАСОВ]](https://i.ytimg.com/vi/CxgOKJh4zWE/mqdefault.jpg)