NEW TCS ON SALE OF GOODS - CALCULATOR | TCS AS PER NEW PROVISIONS OF SECTION 206C (1H)

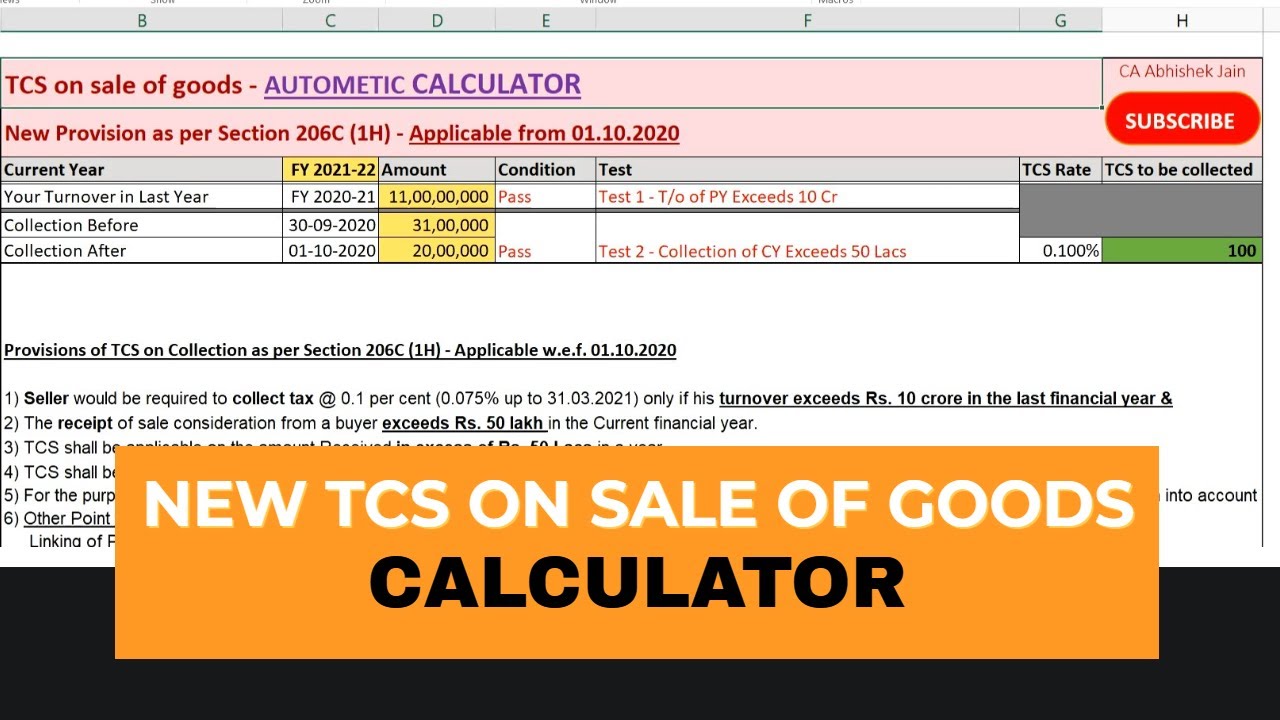

From October 1, 2020, our Government has introduced a new provision for collecting TCS for the sale of goods and depositing the same to the Government. These provisions are given in Section 206C (1H) of the Income Tax Act and here we are discussing this provision in a very simple language with some practical examples so that the Taxpayers can understand the New provisions and follow them easily since it is a new provision. further to make it easy for all my viewers, I have developed an excel utility "TCS Calculator as per provisions of section 206c (1h)" through which you can check whether these new TCS provisions are applicable to you or not & you will also be able to know how much TCS you have to collect from the buyer.

Download Excel Utility from here: - [ Ссылка ]

Download NEW TCS Press Release from here: - [ Ссылка ]

WATCH TO KNOW:

new tcs calculator on sale of goods above 50 lacs w.e.f. 01.10.2020

new tcs provisions,

new tcs on sale of goods,

new tcs rule,

new tcs section 206c(1h),

new tcs on sales exceeding rs. 50 lakhs,

new tcs section 206c 1h,

new tcs on sales in hindi,

How to calculate TCS on sale,

Who is liable to collect TCS,

TCS on sale,

why tcs deducted on sale,

why tax on sale deducted,

taxonsale,

new tax on sale,

New Tax on sale,

New tax on receipt above 50 lacs

Is TCS applicable on export,

Ca abhishek jain

TCS,

TDS,

New section of TCS,

Section 206 C (1H),

GST,

TAX,

Income tax,

ITR,

Sale,

Please ♥Like ♥ Share ♥Subscribe

#TCSCALCULATOR

#tcsonsalecalculator

#tcsonsale

#howtocalculatetcsonsale

#tcs

#tcsreturn

#incometaxnewchanges

#incometax

#tds

#rateoftcsonsale

#whytcsdeuctedonsale

#whotodeducttcsonsale

#thresholdoftcsonsale

#tcssaleamount

#206C(1H)

#caabhishekjain

If you like the video, please LIKE and SHARE it with your friends on social sites. Subscribe to this channel so that you do not miss out on the new videos on this series.

ALSO, WATCH

1) HOW TO FILE ITR 1 OF AY 2020-21:[ Ссылка ]

1A) HOW TO FILE ITR 2 ONLINE: [ Ссылка ]

1B)HOW TO FILE ITR - 4 AY 2020-21| NEW ITR 4 FY 2019-20 | AY 2020-21 LIVE FILING | CA ABHISHEK JAIN: [ Ссылка ]

1C) New ITR V of AY 2020-21| ITR-V not showing income | How to E-verify ITR 2020 | CA ABHISHEK JAIN

: [ Ссылка ]

1D) ITR FILING IS COMPULSORY IN FY 2019-20 OR AY 2020-21 EVEN IF YOUR INCOME IS ZERO OR BELOW LIMIT: [ Ссылка ]

2) New tax slab for fy 2020-21 | Old tax slab V/s new tax slab 2020 | income tax calculator fy 2020-21:- [ Ссылка ]

If you like, make sure to subscribe and comment on youtube.

For #mobile group - t.me/Advance_Excel

DISCLAIMER ********

This video is merely a general guide meant for learning purposes only. All the instructions, references, content, or documents are for educational purposes only and do not constitute legal advice. We do not accept any liabilities whatsoever for any losses caused directly or indirectly by the use/reliance of any information contained in this video or for any conclusion of the information. Prior to acting upon this video, you're suggested to seek the advice of your financial, legal, tax, or professional advisors as to the risks involved that may be obtained and necessary due diligence, etc may be done at your end.

![วิธีทำออมสินไดโนเสาร์ [158] | How to Make Coin Bank Dinosaur at home](https://i.ytimg.com/vi/vJPahDO_hJk/mqdefault.jpg)