Aave is a blockchain-based protocol powering a non-custodial money market that involves borrowers and lenders/depositors.

The network receives liquidity from depositors and allows borrowers to obtain loans using an undercollateralized or overcollateralized approach.

What is #Aave?

The protocol is inspired by ETHLend, a decentralized peer-to-peer lending platform. The network provides lending by creating a market. Apart from providing these services to #DeFi enthusiasts, the Aave protocol also allows similar products to be built on top of its platform and powered by the Ethereum blockchain.

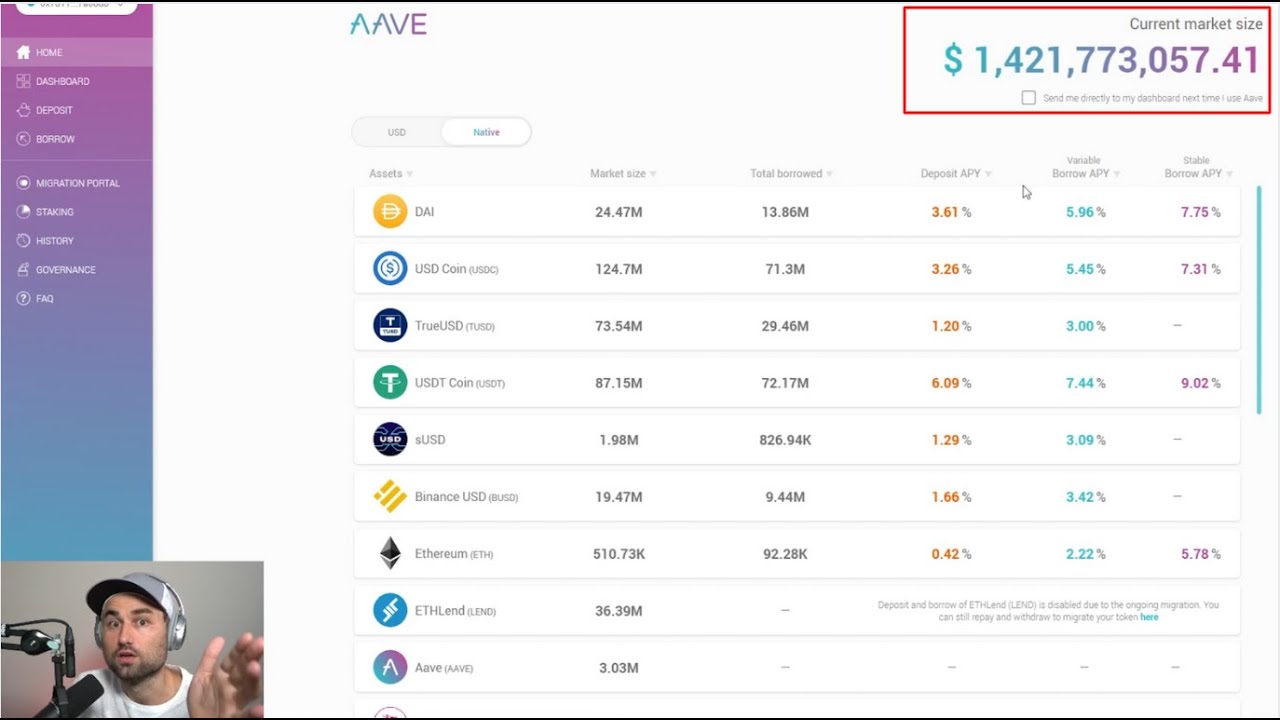

Aave protocol employs the use of pools where depositors deposit their cryptocurrency. However, the pools are divided according to the cryptocurrency deposited. Depositors then become lenders and earn an interest charged on borrowers. Using a pooled approach, borrowers borrow from a pool and not from an individual depositor, effectively evading the p2p model used by other decentralized platforms. Aave supports Tether (USDT), #DAI, #Ethereum (ETH), wrapped #Bitcoin (WBTC), Yearn.Finance (YFI), and 14 other cryptocurrencies.

Table of contents

0:00 Intro

0:14 What is Defi

0:50 Basics of Aave

1:52 Depositing ETH in Aave

3:53 Borrowing on Aave

5:43 Collateral ratio

![[MLP 5 Season]Rainbow Dash: Just stop Winter! Sparta Venom Remix (My Version)](https://i.ytimg.com/vi/qsxWbMkGGUk/mqdefault.jpg)