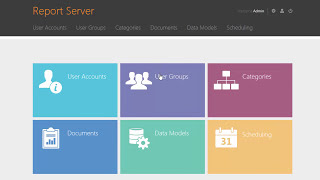

VAT compliance is still dominated by manual processes. Especially purchase invoices are usually processed manually in order to identify potential VAT compliance risks. However, such a manual approach is slow, prone to errors and often reduced to basic spot checks. Deloitte and Hypatos collaboratively developed a state-of-the-art, AI-enabled Tax CMS tool. As VAT compliance manager, the VAT Checker is capable to automatically detect potential VAT compliance risks from any purchase invoice. Identified issues are then forwarded for a further in-depth investigation. The tool thereby enables our clients to efficiently address potential tax compliance issues before input VAT deduction is declared to the tax authorities. Additionally, a VAT analytics solution provides an overview of all investigated purchase invoices. Practitioners can particularly leverage the provided analytics dashboard to retrospectively assess identified VAT compliance risks in preparation of an upcoming tax audit.

Follow us on Social Media / Besucht uns auf Social Media:

● LinkedIn: [ Ссылка ]

● Twitter: [ Ссылка ]

● XING: [ Ссылка ]

● Facebook: [ Ссылка ]

● Instagram: [ Ссылка ]

Get more information about Deloitte on our website / Besucht auch unsere offizielle Website für News, aktuelle Studien, Trends, Stellenangebote und Infos rund um Deloitte:

● Website: [ Ссылка ]

● Karriere: [ Ссылка ]