Visit www.ertcdone4u.com to get more details and fill out a short form to have a dedicated professional see if you qualify.

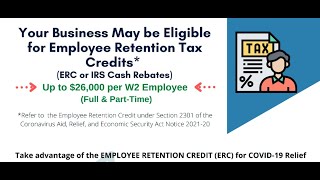

I'm helping businesses that have been affected by shutdowns or any other pandemic-related losses collect up to $26,000 per W-2 employee on record as an Employee Retention Tax Credit (ERTC)

The Cares Act still holds millions of dollars that will get filtered back into politicians' pockets if the American public doesn't stand up and take what is being made available.

If you had less than 100 and 500 W-2 employees, respectively, that you paid in 2020 or 2021 you likely qualify for the ERTC tax rebate even if you received a PPP loan.

The average rebate seems to be around $150k but varies based on how many employees you have.

You probably qualify for more than you think – every single business I’ve seen so far has qualified for much more than they expected! See the image for a small list of companies we've helped so far.

There is no cost and no obligation to find out if you qualify and get an estimate on your cash rebate!

![Курс FL STUDIO для начинающих — Урок 1. Создаем первый трек в ФЛ СТУДИО 20/21 [Fruity Pro Help]](https://i.ytimg.com/vi/Ip2fBSOXH_U/mqdefault.jpg)

![Ирина Вырлина. Нумерология Таро [2024-02-02]](https://i.ytimg.com/vi/4QW00KJCzDs/mqdefault.jpg)