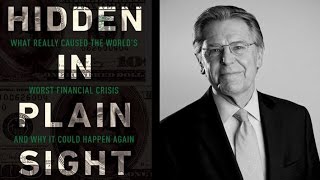

Almost everyone agrees that the poor quality of US mortgages before the financial crisis was to blame for the devastating events of 2008. In almost all media accounts, the usual culprit is lax regulation that permitted excessive Wall Street risk taking. In his new book, “Hidden in Plain Sight: What Really Caused the World’s Worst Financial Crisis and Why It Could Happen Again” (Encounter Books, 2015), however, Peter Wallison argues that US government housing policies were the principal cause of the financial crisis.

Wallison’s book also debunks many of the commonly assigned causes of the crisis — financial deregulation, credit default swaps, and many others — but shows that the affordable-housing requirements imposed on government-sponsored enterprises in 1992, the use of mark-to-market accounting after the market for mortgage-backed securities had virtually disappeared, and government bungling in rescuing Bear Stearns while letting Lehman Brothers fail were the major reasons for the 2008 financial panic.

During this event, Wallison will present on his book, followed by a panel discussion and book-signing reception where copies of “Hidden in Plain Sight” will be available for purchase.

Subscribe to AEI's YouTube Channel

[ Ссылка ]

Like us on Facebook

[ Ссылка ]

Follow us on Twitter

[ Ссылка ]

For more Information

[ Ссылка ]

Hidden in plain sight: What caused the world's worst financial crisis and why it could happen again