Since May 2020, when the government approved COVID-19 economic relief programs for small businesses, the Payment Protection Program (“PPP”) and the Economic Injury Support Loan (“EISL) fraud has made constant headlines.

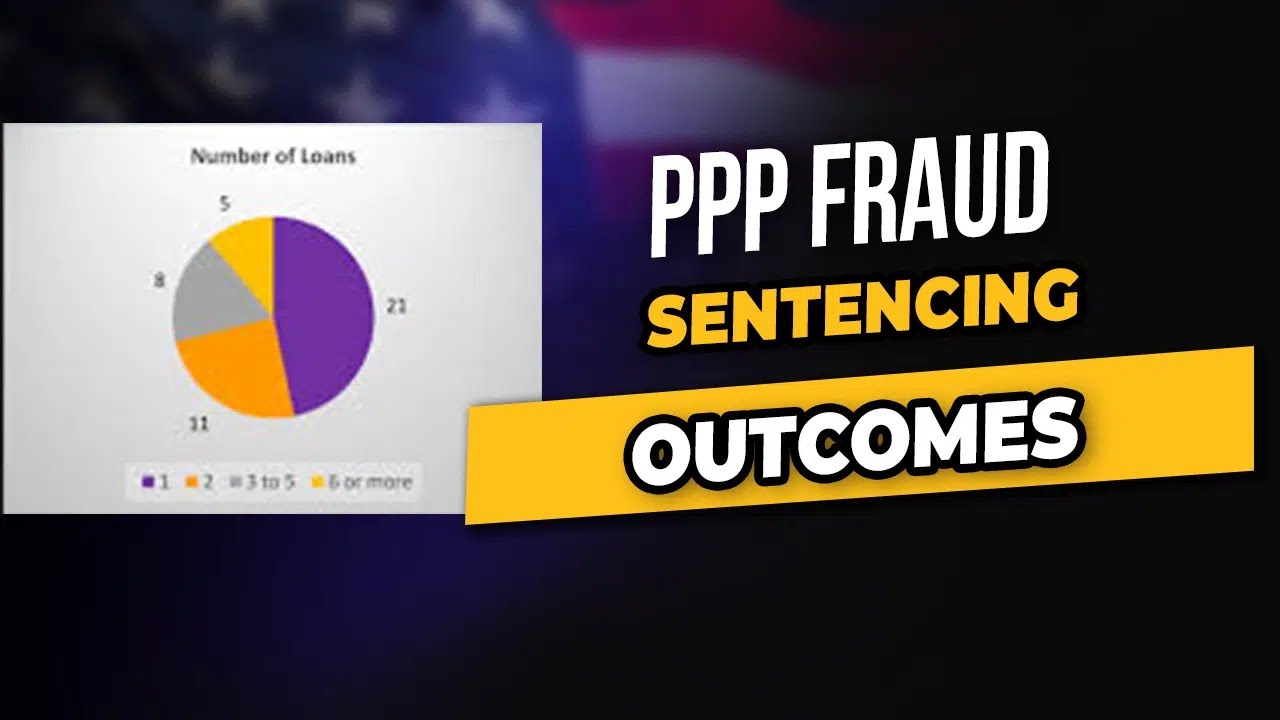

As more and more cases march towards sentencing hearings next, let’s look at the sentencing outcomes to date.

As soon as the government rolled out the PPP loan program in May 2020, federal law enforcement also began investigating allegations of fraud. These investigations involved, among other things:

Fraud in the PPP (and EISL) loan application process.

Disbursement of loans to non-qualified individuals or businesses; and

Misuse of proceeds from PPP loans, designed to cover payroll and other business expenses.

Those initial law enforcement investigations quickly turned into arrests and prosecutions against hundreds of people. To this day, the government continues to file new PPP loan fraud cases every week.

Most cases are now at a stage where, after pleading guilty, defendants are completing their pre-sentence investigations and prepare to face facing the sentencing judge at a sentencing hearing.

Let’s look at how prosecutors and federal judges are approaching sentencing for PPP loan fraud defendants. For example, is the primary consideration the loan amount? Are most defendants going to prison, or are many also considered for probation? What is the average prison term?

As of now, the evidence is more anecdotal than not, but we will monitor developments closely as more defendants face sentencing.

One question many people ask online and social media are, “Do people go to prison for a $20k PPP loan?” suggesting that jail or prison for a $20k PPP loan might not be a possible outcome.

The reality is that people go to prison for $20,000 PPP loan fraud. While sentencing judges determine a defendant’s prison sentence on a case-by-case basis, time in jail or prison cannot be ruled out. Indeed, current cases show most PPP loan fraud sentences include time in prison.

For people whose cases involve smaller loan amounts, the problem remains that prosecutors and sentencing judges often want to make an example out of anyone who participated in PPP loan fraud.

And, Acting US Attorney Nicholas Ganjei explained his reasoning in going after PPP loan fraud aggressively:

“Stealing limited COVID relief funds is the very definition of stealing from the less fortunate… Every dollar that was stolen and extravagantly spent ….was one less dollar that went to a struggling business scrambling to meet its payroll obligations to employees. The Department of Justice and its partners will do everything in their power to investigate and prosecute those that would deign to steal these limited funds and stall national recovery efforts.”

This sentiment can be worrisome for anyone who participated in allegedly fraudulent PPP loans, regardless of the loan amount.

At the sentencing of Ganell Tubbs, a woman who pleaded guilty to PPP loan fraud of $2 million, the sentencing judge handed down a sentence of 41 months in prison. Judge Brian Miller’s comments at the sentencing hearing provide insight into how a Judge might think about the unique or mitigating circumstances of a PPP loan fraud defendant.

The Judge admitted that it was difficult for him to decide on Tubbs’ sentence, which carried up to 30 years in prison and a $1 million fine. Tubbs claimed close to $2 million in PPP loans for businesses that did not qualify. Tubbs used the loan proceeds to pay off personal debts, student loans and purchase many goods and services.

Judge Miller noted that the government was able to find the fraud quickly and recovered all but $14,000 of the loan money. Still, he could not give Tubbs a complete pass for this.

“Should Miss Tubbs get the benefit of the fact that the government figured it out quickly?” Judge Miller asked aloud, questioning why the bank gave Tubbs the loans with little to no documentation.

“On the other side of that equation, she walked in and defrauded them,” Judge Miller said. “It was a bad fraud, but she actually went in there and did it.”

Tubbs’ lack of criminal history had an impact on the Judge. “It is not like she is somebody who has been running around robbing people for the last 10 years,” he said. “Three years in prison is like 20 years for some other people. Some people can go to prison and knock out those years like it is nothing. For someone like Miss Tubbs, it is really a harsh environment.”

Based on Tubbs’ lack of prior criminal history and her quick acceptance of responsibility, Judge Miller sentenced Tubbs at the bottom of the sentencing guidelines, which suggested a 41- to a 51-month prison sentence.

The Tubbs case shows how a federal sentencing judge considers different factors to ultimately decide on a sentence in a PPP loan fraud case.