Bitcoin was the best-performing asset class across US markets in 2024, and since inception has increased in value over a thousand times.

Now global central banks, sovereign governments, and even key members of the US Congress and Federal Reserve are racing to build a "strategic reserve" of Bitcoin.

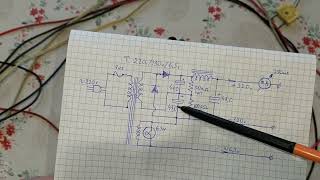

One of Bitcoin's most attractive features to investors is that its total supply is capped, at 21 million BTC. Over time, Bitcoin become increasingly more difficult to "mine", requiring ever-higher volumes of electricity and computing power. For the countries that can mine the remaining BTC faster and more efficiently, the advantages are obvious, and enormous.

Bitcoin is banned in Mainland China. Ironically, however, China has a near-total monopoly on the mining rigs that mine the Bitcoin. Almost all the hardware is built here and exported, and 98% of the advanced semiconductor chips used in mining rigs are Chinese.

China, then, finds itself in a strange position: though the country forbids Bitcoin mining and trade in-country, it can exert great influence in determining where the ever-diminishing supply of new Bitcoins will be created, and by whom.

Resources and links:

Substack, for video transcript and direct links

[ Ссылка ]

Russia is mining a hot cryptocurrency, trying to solve one big trade problem

[ Ссылка ]

Swiss Central Bank Faces Growing Calls To Hold Bitcoin Reserves

[ Ссылка ]

Governments and banks once mocked Bitcoin. Now they want in on it

[ Ссылка ]

El exministro de Finanzas de Alemania sugiere al BCE incorporar el bitcoin y otras criptomonedas a sus reservas

[ Ссылка ]

Electricity Costs to Mine 1 Bitcoin at Home, Around the World

[ Ссылка ]

China has a Trojan Horse in US Bitcoin mining infrastructure

[ Ссылка ]

Reuters, What and where are Russia's $300 billion in reserves frozen in the West?

[ Ссылка ]

The Russian sanctions and dollar foreign exchange reserves

[ Ссылка ]

Forbes, Fed Suddenly Flips On Huge $3 Trillion Bitcoin And Crypto Price Boom

[ Ссылка ]

Closing scene, Dalian, Liaoning