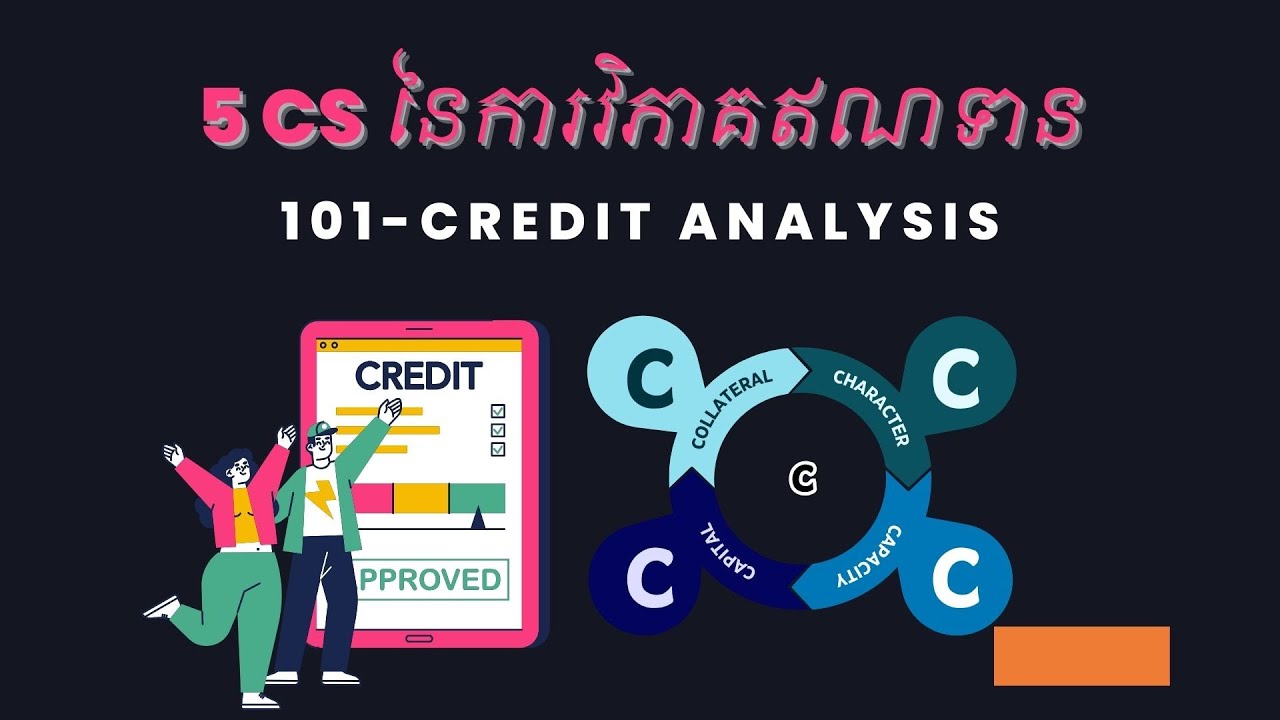

The 5 Cs of Credit Analysis are key factors that lenders evaluate to determine a borrower’s creditworthiness. Here's a quick summary:

1. **Character**: The borrower's trustworthiness, reputation, and reliability in repaying debts. It’s often assessed through credit history and references.

2. **Capacity**: The borrower’s ability to repay the loan, evaluated using income, employment stability, and debt-to-income ratio.

3. **Capital**: The borrower’s personal investment or contribution to the project or purchase, indicating commitment and reducing lender risk.

4. **Collateral**: Assets pledged by the borrower as security for the loan, providing assurance to the lender in case of default.

5. **Conditions**: External factors like economic trends, market conditions, or specific loan terms that might affect repayment.

These principles help lenders make informed decisions while guiding borrowers on improving their credit profiles.