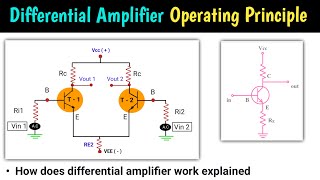

Dow Theory is based on the foundational work of Charles Dow, considered the "Father of Technical Analysis." When the Dow Industrials and Dow Transports do not confirm a new high, we have a "bearish confirmation" which indicates trend exhaustion. We'll walk through this traditional Dow Theory, along with two more modern versions and what to expect through the end of Q2.

What do you see happening for the S&P 500 and Nasdaq through the end of Q2? Drop a comment and let me know!

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Take my FREE course "The Five Modes of Mindful Investors" here: [ Ссылка ]

Follow me on Twitter: [ Ссылка ]

Enjoy the video? Feel free to buy me a coffee. [ Ссылка ]

Check out Seeking Alpha Premium, including access to all premium articles as well as their exclusive Quant Ratings, and enjoy a double-sized free trial using my link: [ Ссылка ]

The best investors are voracious readers. Audible allows you to consume books on the go! Free 30-day free trial using my link: [ Ссылка ]

Ready to take the next step on your journey to more mindful investing? Check out our premium memberships.

[ Ссылка ]

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Dave helps active investors and financial advisors make more informed investment decisions, inject more discipline into their investment process, and enrich relationships with their clients. Feel better about making better decisions!

Dave is the Chief Market Strategist at StockCharts.com, where he helps investors minimize behavioral biases through technical analysis. He is a frequent host on StockCharts TV, and he relates mindfulness techniques to investor decision making in his blog, The Mindful Investor.

He's also President and Chief Strategist at Sierra Alpha Research LLC, a boutique investment research and consulting firm focused on managing risk through market awareness. He combines the strengths of technical analysis, behavioral finance, and data visualization to identify investment opportunities and enrich relationships between advisors and clients.

Dave was previously a Managing Director of Research for Fidelity Investments in Boston, a Past President of the Chartered Market Technician (CMT) Association, and started in the financial industry just after the March 2000 market top at Bloomberg in New York.

✔ W E B S I T E

[ Ссылка ]

✔ T W I T T E R

[ Ссылка ]

✔ L I N K E D I N

[ Ссылка ]

✔ F A C E B O O K

[ Ссылка ]

The content in this presentation should not be considered as a recommendation to buy or sell any security. All information is intended for educational purposes only and in no way should be considered as investment advice. Some of the links in this description and in the video may be affiliate links, which means you pay nothing more and it helps me to make Market Misbehavior awesome! As an Amazon Associate, I earn from qualifying purchases. For full disclaimer, please see our website: [ Ссылка ]

#MarketMisbehavior #stockmarket #stock #stocks #technicalanalysis #behavioralfinance #equities

![КАК ШЛИМАН ТРОЮ ОТКАПЫВАЛ [История с Artifex]](https://s2.save4k.su/pic/Xicvt02FmUY/mqdefault.jpg)