If you run a small business, or you’re thinking about starting one up, you’ll need to figure out if you want to hire employees or contractors. But… what’s the difference?

According to IRS.gov, there are three main differentiators between these two groups:

First there’s Behavioral: Contractors typically control what specific work they do and how they do it, while Employees do not.

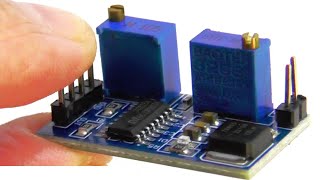

Next is Financial: How the worker is paid, if/how expenses are reimbursed, and who provides tools or supplies are big deciding factors. Typically, employees have these decisions made for them, while contractors handle this on their own.

Lastly is the Type of Relationship: Are there benefits like insurance, pension plans, vacation pay, etc.? And is the relationship performed continuous and a major part of the business? If so, that’s probably an employee. If not, you’re looking at a contractor.

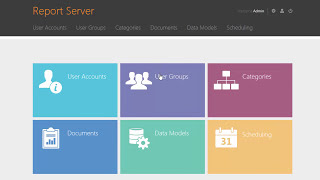

This all is important because your workers’ classifications determine how they’re paid and how their tax withholdings work, so keep that in mind! Luckily, there are tons of payroll software options out there that help with these sorts of tasks.

Hope that helps, and be sure to like and subscribe for more TechnologyAdvice.

![Как работает Клавиатура? [Branch Education на русском]](https://s2.save4k.su/pic/xCiFRXbJTo4/mqdefault.jpg)

![Самые странные вещи во Вселенной [Неразгаданные тайны космоса]](https://s2.save4k.su/pic/Nr69rBt82jg/mqdefault.jpg)