To learn more about Tier 1 Alpha research: [ Ссылка ]

This video is part of a 60-minute primer on "Systematic Flows: How Mechanical Buying and Selling Drives Volatility And Trend In The Stock Market."

Watch that full video here: [ Ссылка ]

When an investor buys an option contract, there is almost always a market maker on the other side of the trade. The goal of an Options Dealer is to collect the premium from the sale while avoiding as much directional risk as possible.

To avoid directional risk, Dealers employ a strategy called Delta Hedging, where they take an opposing position in the underlying asset to offset the risk associated with price movements in the option

contracts they have sold.

As the spot index moves around throughout the day, market makers must frequently adjust their hedges, by buying and selling the underlying asset in order to maintain their delta-neutral position.

In addition to adhering to their internal risk management policies, Option Dealers are also subject to regulatory limits on risk-taking in the post-Dodd-Frank era. As a result, dealers are essentially forced into

hedging in this way.

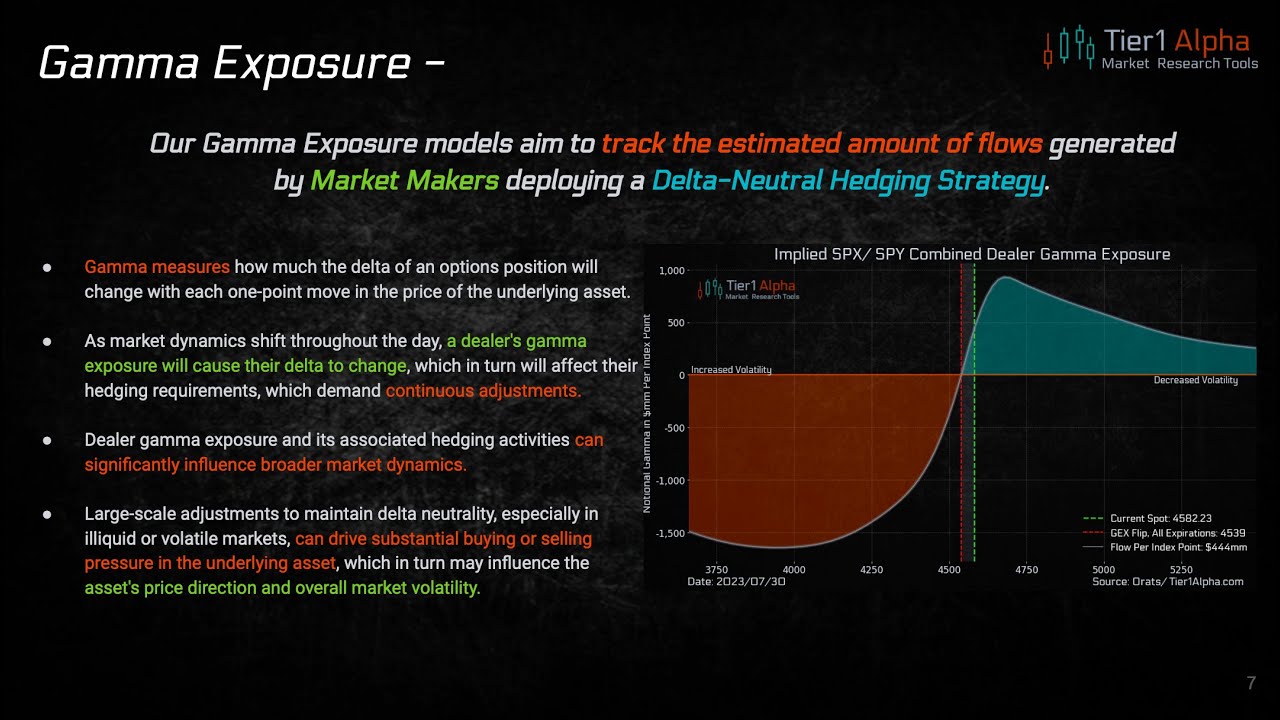

Gamma measures how much the delta of an options position will change with each one-point move in the price of the underlying asset. Our Gamma Exposure models aim to track the estimated amount of flows generated by Market Makers deploying a Delta-Neutral Hedging Strategy.

![Как приготовить ХОЛОДЕЦ из курицы в мультиварке (без желатина). НОВОГОДНИЙ рецепт [Семейные рецепты]](https://i.ytimg.com/vi/elTkkybKFrw/mqdefault.jpg)

![ТАК ЛЕГАЛЬНО КИДАЮТ при ПОКУПКЕ КВАРТИРЫ в РОССИИ! [2024]](https://i.ytimg.com/vi/qn4fHzUwsjA/mqdefault.jpg)