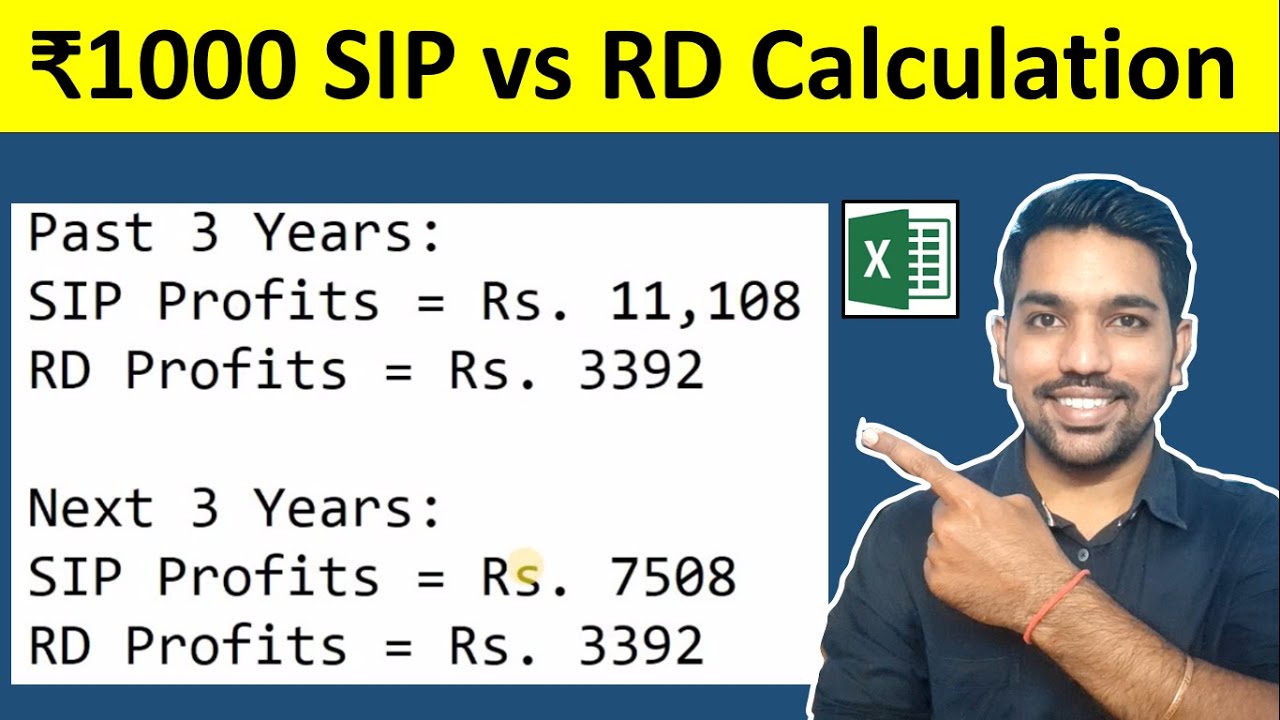

₹1000 SIP vs RD Returns Calculation | Which is Better between SIP & RD?

In this video by FinCalC TV we will see how much returns you can get with Rs. 1000 SIP or RD in hindi. SIP full form is systematic investment plan and RD full form is Recurring Deposit.

SIP Calculator:

[ Ссылка ]

RD Calculator:

[ Ссылка ]

JOIN Telegram Group:

[ Ссылка ]

Mutual Funds for Beginners Playlist:

[ Ссылка ]

CHAPTERS:

00:00 SIP vs RD Investment in Hindi Intro

01:05 What is SIP & RD full form & Features?

02:30 SIP Returns Calculation

03:22 Mutual Funds Units Calculation

05:04 Calculating Maturity amount & Profits in SIP

07:02 Recurring Deposits Interest Calculation

11:27 SIP vs RD Investment Conclusion

XIRR Calculation video:

[ Ссылка ]

WHAT IS MUTUAL FUND SIP CALCULATOR?

SIP (Systematic Investment Plan) calculator is a calculator that helps you know how much profit you can expect from mutual funds based on your deposits and expected rate of return. This helps you in defining and planning for your goals according to the amount of deposit you can afford to contribute every month.

SIP can be monthly, quarterly, half yearly or yearly as well. The above calculator helps your calculate your SIP returns based on monthly deposits as monthly frequency of deposits are more common.

WHICH SIP IS BEST FOR 5 YEARS?

There are many mutual funds that you can invest in. It is important to understand what are the factors you should see while selecting best mutual funds if your goal is for 5 years or more.

Some of the factors include:

- Expense Ratio: this is the fees taken by AMC (Asset Management Company) in order to manage your funds. This is yearly fees and should be as low as possible while selecting mutual fund

- AUM: This is Assets under Management, which means, total amount of money being invested by people in the mutual fund. More money being invested by people, means more trust on this mutual fund. But this is not the case always as some already popular AMC tries to sell specific mutual funds to people who are not aware about mutual fund factors to consider while increasing it’s AUM.

- Past Returns: Although, past returns does not guarantee future returns of a mutual fund, but it is important to check this stat while selecting best mutual fund for SIP for 5 years.

- Stocks Portfolio: Another important factor to check is the list of stocks present in mutual fund portfolio. Every mutual fund has a fund manager associated to it who selects list of stocks in order to maximize returns on your investments. If you invest in stocks or have idea about stock investing or fundamental analysis, you should definitely see the list of stocks present in mutual fund’s stock portfolio.

WHAT IS RD?

RD or Recurring Deposit is one the popular saving options in India that will help you to accumulate some predefined amount with the help of regular savings in Recurring Deposit. You can easily open RD in your bank using Internet banking or in post office. RD is usually done to achieve short term goals with no risk involved. The maturity amount in RD is guaranteed hence there is no risk. Recurring Deposit Interest Calculator will help you to know the interest you’ll get in Recurring Deposit.

GOALS WHILE OPENING RD ACCOUNT

It is important to have goals in mind before opening a RD or Recurring Deposit. You can have below short term goals while booking an RD:

- To buy a new smartphone with budget around Rs. 10,000, you can open a RD of Rs. 2,000 for 6 months

- To pay your Life insurance premium of Rs. 35,000 next year, you can open RD of Rs. 3,000 for 12 months

Similarly, you can open RD for goals you feel are important for next 6 months of 1 year. This helps you accumulate funds gradually without any pressure of spending the current funds in one go instantly!

#sip #sipcalculator #fincalc

==================

LIKE | SHARE | COMMENT | SUBSCRIBE

Mujhe Social Media par FOLLOW kare:

Facebook : [ Ссылка ]

Twitter : [ Ссылка ]

BLOG: [ Ссылка ]

Telegram: [ Ссылка ]

Instagram: [ Ссылка ]

==================

MORE VIDEOS:

SIP Excel Calculator: [ Ссылка ]

Income Tax Calculator: [ Ссылка ]

Loan EMI Calculator: [ Ссылка ]

Loan EMI Prepayment Calculator: [ Ссылка ]

ALL EXCEL CALCULATORS VIDEOS:

[ Ссылка ]

==================

DISCLAIMER:

Examples and demo used are for Illustration purpose only and might not cover every detail of examples shown. It is advised to seek professional help before taking any financial decisions. The owner of this channel shall not be liable in any way.

![КОММЕРЧЕСКОЕ СВЕДЕНИЕ DEEP HOUSE ТРЕКА [ПОШАГОВОЕ РУКОВОДСТВО ПО СВЕДЕНИЮ] АРАМ КИРАКОСЯН](https://i.ytimg.com/vi/eMT18t0xtnU/mqdefault.jpg)