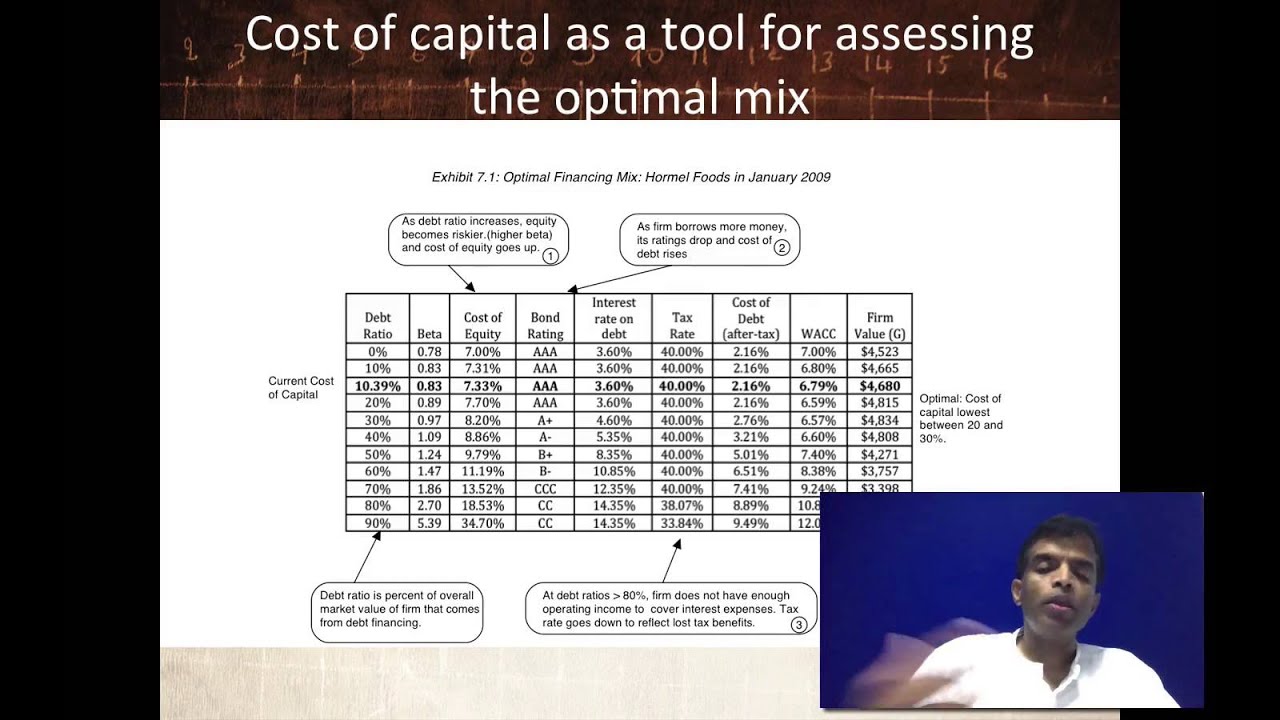

In this session, we look at activist value investing, where you not only buy cheap companies, but also provide the catalysts for prices to adjust to value. In particular, we examine the strategy of investing in poorly managed companies and changing their asset mix, capital structure, dividend policy and corporate governance with the intent of increasing value (and price) over time. We classify activist investors into three groups, lone wolves (individual investors), activist mutual funds and activist hedge funds/private equity investors and examine differences in how they approach investing.

![[中文字幕] 唯識三十頌 - 第二十一講 - 觀成法師主講](https://i.ytimg.com/vi/bhyeS9kzvzQ/mqdefault.jpg)