G’day mate! If you own a Shopify store in Australia, you need to know when to charge goods and services tax (GST) to your customers.

GST is a 10% tax charged for almost everything that gets sold in Australia.

This video will help you configure your Shopify taxes correctly, taking Australia’s taxation changes valid from March 2023 into account.

It’s a little intimidating, but we’re sure Djimi can explain it—from tax-exemptions to digital goods—it’s all covered in this quick and easy video guide!

For more information, read through our GST guide for Shopify stores in Australia: [ Ссылка ]

Learn more about GST-free sales:

[ Ссылка ]-(and-when-not-to)/gst-free-sales/

Sufio is the leading invoicing app for Shopify merchants worldwide, including the UK. Our powerful and automated solution makes invoicing easier than ever, leaving you with more time to focus on growing your business. Whether you’re about to launch your first ever store or you’ve already made it a household name, you can count on Sufio’s customer success team to help you configure both your invoices and taxes with compliance in mind.

Start your 14-day free trial today to experience the peace of mind automated invoicing provides: apps.shopify.com/sufio?ref=YouTube_t47ZFzqDQXQ

⚠️ While we’re happy to make educational videos about setting up Shopify taxes, we encourage you to speak to a local tax authority regarding your tax duties.

––––––––––––––––––––––––––––––––––––––––––––

Here's what we'll cover in this video:

0:00 — Introduction

0:14 — GST in Austra

0:48 — Not GST registered

1:08 — GST registered

1:48 — B2B and B2C

2:13 — GST-free, input-taxed sales

3:18 — Digital goods

3:48 — International sales

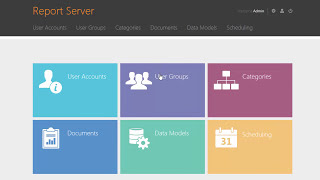

4:56 — Set up taxes in Shopify store