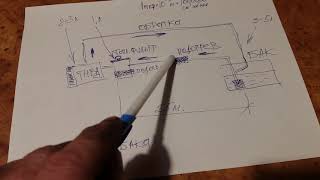

In this video, I introduce the basics of quantitative trading and showcase a mean reversion strategy using a specific stock as an example. You'll see how to use a Copilot #prompt to generate Python code for developing a backtest. We’ll run this code to produce output in CSV format, and I’ll explain the details and demonstrate how to verify the results.

Next, I’ll guide you through the process of position sizing your trades and evaluating the strategy by varying key trade parameters. Using insights from the R-multiple, I’ll show you how to optimize these parameters for better performance. Finally, we’ll pass the equity curve to #Pyfolio to analyze the backtesting metrics and assess the strategy's effectiveness.

By the end of this video, you’ll have a clear understanding of how to conceptualize a #quantitative strategy, backtest it with #Python, and evaluate its performance metrics.

For more insights and resources, visit our website: [ Ссылка ]

![[4K] Transparent Clothes Try On Haul | October 2024 No Bra Trend | Petite Olya](https://i.ytimg.com/vi/EPW1IZnyLvA/mqdefault.jpg)