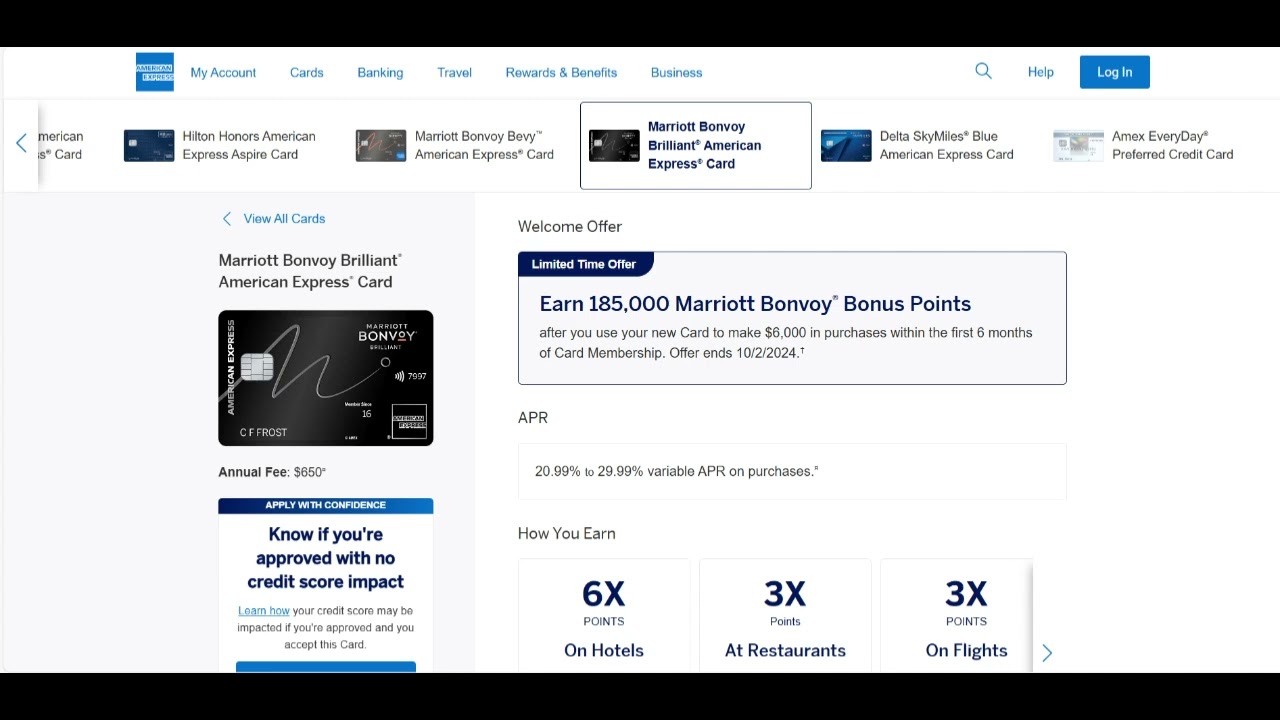

The Marriott Bonvoy Brilliant American Express Card is a top-tier choice for travelers who are deeply invested in the Marriott Bonvoy program and want to elevate their travel experience. This card offers an impressive earning structure with 6x points on Marriott purchases, 3x points at U.S. restaurants and on flights booked directly with airlines, and 2x points on all other eligible purchases. One of the card's most valuable perks is the annual free night certificate, which is now valid for properties requiring up to 85,000 points, allowing you to enjoy stays at some of Marriott’s most luxurious hotels.

The card also comes with automatic Gold Elite status, which provides benefits like room upgrades and late checkout, enhancing your hotel stays. However, the real game-changer is the annual $300 Marriott statement credit, which can be used at any Marriott property, effectively lowering the card's hefty $650 annual fee. Additionally, the card offers up to $100 in property credits on qualifying two-night stays at St. Regis or The Ritz-Carlton hotels, adding a touch of luxury to your travels.

Another standout feature is the Priority Pass Select membership, granting access to over 1,300 airport lounges worldwide, which is perfect for frequent flyers looking to relax before their flights. The card also includes a Global Entry or TSA PreCheck fee credit, making it easier to breeze through airport security.

However, the Marriott Bonvoy Brilliant Card isn't without its drawbacks. The $650 annual fee is substantial, and while the card offers many perks, it requires a significant level of Marriott loyalty and travel frequency to fully justify the cost. Additionally, while the Gold Elite status is nice, some might expect the card to offer Platinum Elite status given its premium positioning, which would provide even more valuable benefits like guaranteed late checkout and enhanced room upgrades.

Another consideration is that the card’s rewards are heavily tied to the Marriott ecosystem. While the points earning potential is high, redemption options outside Marriott properties are limited, which might not appeal to those who prefer more flexible travel rewards. Additionally, some users may find the lack of a broader travel credit—beyond the Marriott-specific $300 credit—a limitation, especially when compared to other premium travel cards in the market.

In summary, the Marriott Bonvoy Brilliant American Express Card is an excellent choice for Marriott loyalists who can take full advantage of its rich benefits. However, the steep annual fee and Marriott-centric rewards structure mean that it may not be the best fit for those looking for more flexible travel rewards or for those who do not frequently stay at Marriott properties.